Harvest Your Assets

Reaching Across Physical & Crypto Space

Harvest Your Assets

Reaching Across Physical & Crypto Space

NFT trading volume, mostly in digital format, keeps increasing with $12 Billion at Q1 2022.

Source: DappRadar

Physical Asset backed NFT, which is more credible than digital contents, opens up a market value of $280 Trillion.

Source: TheTokenizer.io

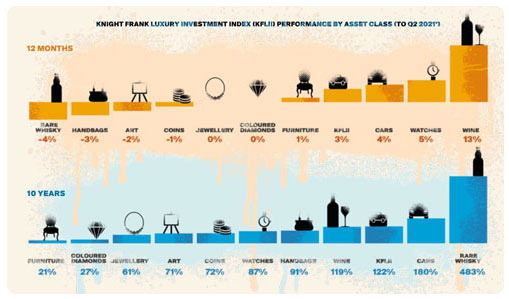

Appreciation of physical assets outperforms conventional investment tools.

Source: www.knightfrank.com

Crypto holders can invest in global physical assets, and Physical Asset owners can liquidate or collateralize into Crypto assets reaching both Crypto (295 Million) and Physical Segments globally.

Source: Crypto.com

Vision

Empowering a decentralized

economy of both crypto and

physical assets

Mission

Providing financial freedom for

physical asset owners and

opportunity for crypto

holders to

invest in physical assets

Execution

Constructing a marketplace

for asset trading using

Fractionalized NFT

(F-NFT)

under five classes

1.What is MESSIA

2.What is the asset onboarding process?

3.How are assets vaulted and valued?

4.How to prove ownership?

5.How to set the price of a fraction?

6.How do I sell my fraction(s)?

7.How do I buy a whole item?